Overtime Calculator

In case you frequently need to work overtime, or you’d just like to get your facts about this type of work straight, here’s a rundown on some basic overtime pay rules including free overtime calculators to help you stay on top of the numbers.

What is overtime pay?

Overtime pay is a type of compensation employees receive when their work hours exceed their regular work schedule.

For example, in case employees have agreed on working 40 hours per week and they end up working longer hours — they are usually entitled to overtime pay.

However, the laws and regulations regarding a standard workweek are usually not universal, and they might differ depending on the employee's country of residence or the company’s policy.

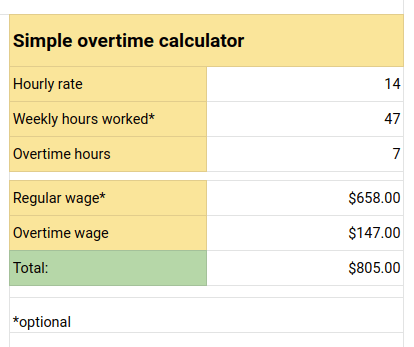

State Labor Law GuidesFor example, the EU labor law states that time worked can't exceed 48 hours per week, including overtime, while the average work hours per week seem to be in the 36-38 range, across the globe.

However, to ensure both employers and employees are protected from malpractice and exploitation, other labor laws regulate overtime by:

- Determining who can be paid for overtime work.

- Setting acceptable hourly rates for overtime pay.

- Auditing, examining, and overseeing the practice of overtime-related laws.

How much is my overtime pay rate?

The Fair Labor Standards Act regulates the overtime pay rate, and it is usually the same across all employee statuses.

Overtime pay for non-salaried employees

According to both FLSA and California Overtime Law, workers who are paid by the hour cannot be paid less than:

- 1.5 times their regular hourly rate, for any given day of the workweek, except for the seventh consecutive day.

- 2.0 times their regular hourly rate when they work over 12 hours on any day of the workweek or over 8 hours on the seventh day of the workweek.

So, if your standard rate is $15 per hour, your regular overtime (1.5x) would be $22.50.

Overtime after 12 consecutive hours (and after 8 hours on the seventh workday) would be $30 per hour.

Overtime pay for salaried employees

Workers who receive a salary and are eligible for overtime pay, get paid the same way as hourly workers — except that their calculations begin with a flat rate (their salary). If a person receives payments monthly, you can calculate overtime pay in a few simple steps:

- Divide the pay by four work weeks to get their weekly pay (e.g. $1.830 per month — $1830/4 = $457.50 per week).

- Divide the week's pay by the number of hours worked (e.g. $457.50 per week — $457.50/47 = $9.73 per hour).

Then, when calculating overtime, you should keep in mind that it starts at 40 hours — so, in the above example, we have 7 hours of overtime.

Therefore, the worker should be paid $9.73 for each hour in the first 40 hours, and time and a half for each hour of those additional 7 hours.

What is time and a half?

Whenever employees work overtime, they are entitled to an increased rate.

In Europe, this rate might vary depending on the country of residence — regular hourly rate plus 15–75% of their hourly rate.

US employees, as mentioned above, are entitled to a minimum rate of time and a half — their regular hourly rate plus the additional 50% of their hourly rate.

How to calculate time and a half?

To calculate employees’ overtime rate, you can use this simple formula:

Hourly rate x 1,5 = Overtime rate

Let’s say an employee’s hourly rate is $20.

To calculate their overtime rate, simply multiply 20 by 1.5:

20 x 1.5 = 30

However, it’s important to keep in mind that time and a half is the minimum overtime rate established by FLSA.

The rate might go higher depending on different companies’ policies.

Am I eligible for overtime pay?

Overtime compensation isn't available to everyone.

Certain FLSA standards need to be met for someone to be eligible for overtime pay.

Here is a brief rundown of who is (and isn't) entitled to this kind of compensation:

Eligible for overtime pay

Most of the workers covered by the FLSA are eligible for overtime pay.

Both salaried and hourly-paid employees can receive overtime pay, so long as they fall under the FLSA standards linked above.

Here are some examples of eligible employees:

- Freelancers,

- Interns,

- Retail associates,

- Contractors, etc.

Non-eligible for overtime pay

Of course, not everyone is entitled to compensation for overtime.

Such workers are usually called "exempt" because they're exempt from the rules. These include:

- Salaried employees earning more than $684 per week or more than $35,568 per year,

- "White-collar" workers (e.g. managerial, administrative, and desk jobs),

- Seasonal employees,

- Independent contractors, etc.

For a more extensive list of professions not eligible for overtime pay, please refer to this document by the U.S. Department of Labor.

Staying overtime without receiving compensation for the time put in is called working off the clock and could potentially get both employees and employers in trouble.

So, always try to remain up to date with federal and state laws and regulations.

Free overtime calculators

Even though calculating overtime pay is usually not complicated, if you don’t pay enough attention to all the details, you might end up with miscalculations.

To avoid this from happening, you can use the following ready-made calculators and minimize the possibility of errors:

- Overtime Calculator for salaried employees

- Overtime Calculator for non-salaried employees

- Simple Overtime Calculator for non-salaried employees

- Detailed Overtime Calculator for non-salaried employees

- California Overtime Calculator

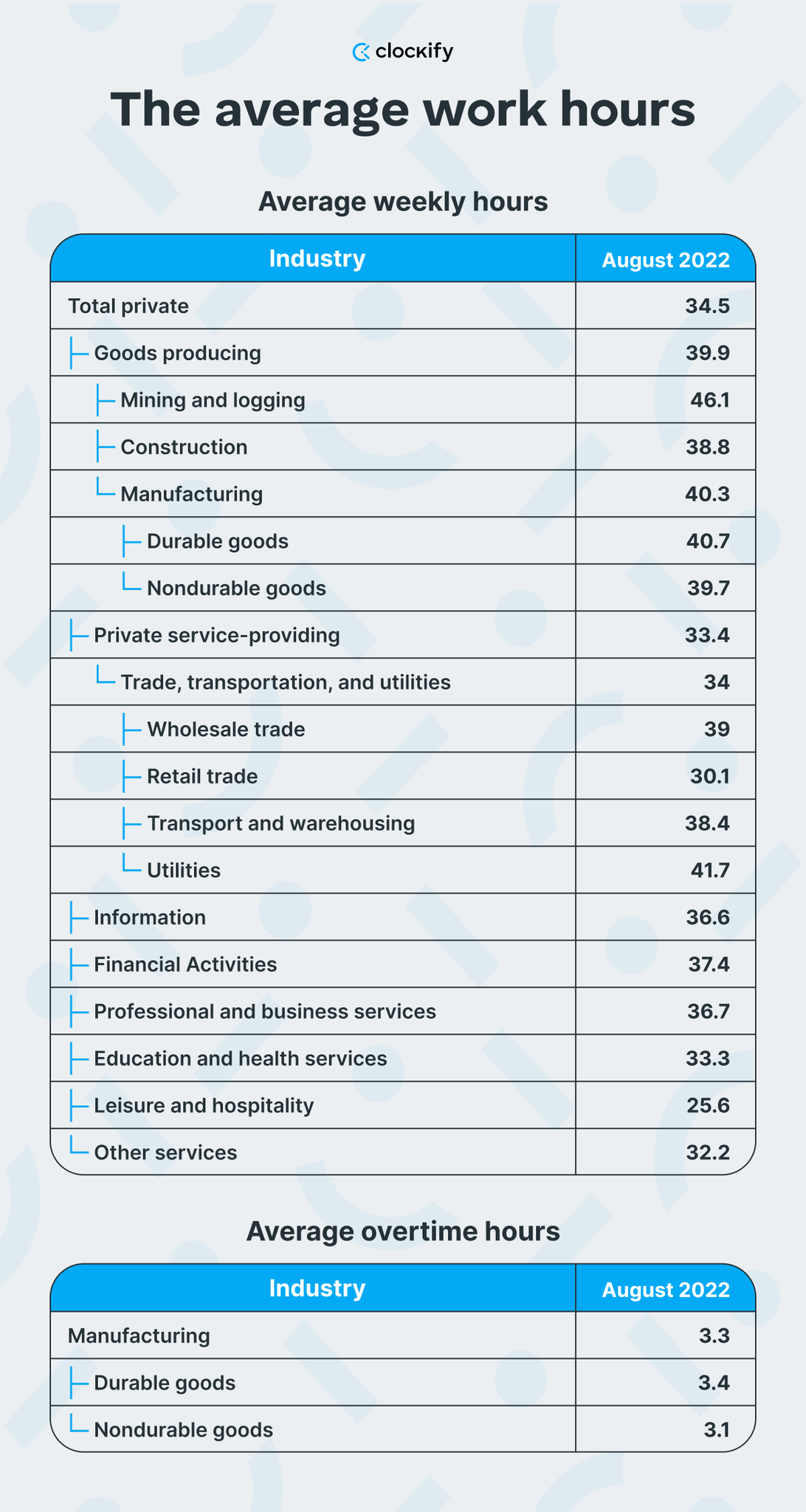

Overtime Calculator for salaried employees

Certain salaried employees are non-exempt from overtime pay.

However, since the process of calculating their overtime pay is slightly different from the one for non-salaried employees, an overtime calculator can be a handy asset for obtaining the most accurate numbers.

GET Overtime Calculator for Salaried Employees

How to use the Overtime Calculator for salaried employees?

To access the Overtime Calculator for salaried employees, click on the link you'll find right above the screenshot.

Once you click the Download link, a new tab will appear with a question: Would you like to make a copy of the XYZ document?

Afterward, simply click on the Make a copy button (you'll need to be logged into your Gmail account for this to work), and this will let you copy and edit the document. You'll then be able to use the calculator.

After you’ve successfully downloaded the calculator, start by adding your monthly salary, and have the calculator break down your weekly salary and hourly rate.

Then, move on to adding your regular weekly hours and the total number of overtime hours you’ve worked during that week — and the calculator will automatically calculate the total overtime pay.

Note: This simple version uses the 1.5x rate to calculate your overtime wage. In case your company’s overtime rate policy differs from the federal minimum, scroll down to the next section for a more detailed overtime calculator.

Overtime Calculators for non-salaried employees

If you’re looking for a way to work out your exact overtime pay without investing too much time in doing calculations, then the Overtime Calculators for non-salaried employees might be just the solution.

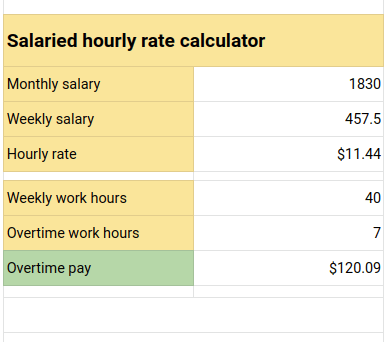

Simple Overtime Calculator for non-salaried employees

Although calculating overtime pay for non-salaried employees is a simple task, if you’d like to simplify this process further, then the following calculator is the choice for you.

GET Simple Overtime Calculator for non-salaried employees

In the above example, we've tried to make things as simple as they get:

- You input your hourly rate;

- Optionally, you can enter your overall weekly hours worked;

- The calculator will show your wage for regular and overtime work hours.

How to use the Simple Overtime Calculator for non-salaried employees?

To access the Simple Overtime Calculator for non-salaried employees, click on the link you'll find right above the screenshot.

Once you click the Download link, a new tab will appear with a question: Would you like to make a copy of the XYZ document?

Afterward, simply click on the Make a copy button (you'll need to be logged into your Gmail account for this to work), and this will let you copy and edit the document. You'll then be able to use the calculator.

Then, start by adding your hourly rate.

Optionally, you can enter your overall weekly hours worked if you’d like.

Finally, the calculator will show your wage for regular and overtime work hours.

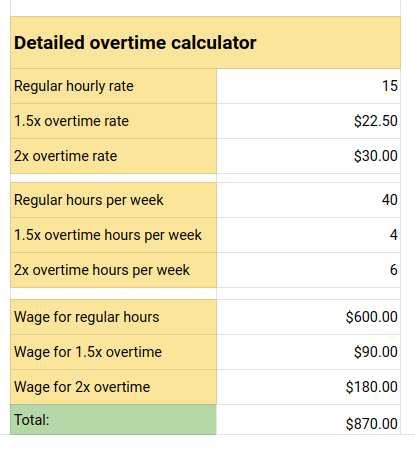

Detailed Overtime Calculator for non-salaried employees

If you’re used to tracking your work hours and you’ve already obtained your exact overtime hours, then the detailed overtime calculator for non-salaried employees can help you calculate your overtime pay in a couple of seconds.

GET Detailed Overtime Calculator for non-salaried employees

How to use the Detailed Overtime Calculator for non-salaried employees?

To access the Detailed Overtime Calculator for non-salaried employees, click on the link you'll find right above the screenshot.

Once you click the Download link, a new tab will appear with a question: Would you like to make a copy of the XYZ document?

Afterward, simply click on the Make a copy button (you'll need to be logged into your Gmail account for this to work), and this will let you copy and edit the document. You'll then be able to use the calculator.

Then, after opening the calculator, start by entering your hourly rate.

Immediately after, you’ll see your hourly rate multiplied by 1.5 and 2.

You’ll obtain two different overtime rates — which might prove useful if your company’s overtime rates are higher than the federal minimum overtime rate.

This version is also helpful if we assume that you have a timesheet showing how much 1.5x or 2x overtime work hours you've logged.

You can input that information as well, and then, the calculator will calculate the wages for all your work hours — and sum them all up in a weekly wage total at the bottom.

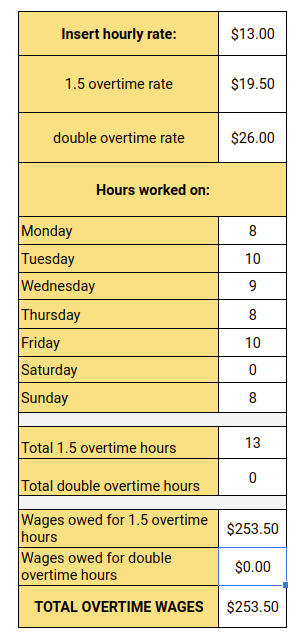

California Overtime Calculator

Since California overtime law has its own specific conditions, it's wise to have a separate calculator on the ready. California law treats both every hour worked over 8 hours per day, and every hour over 40 hours per week as overtime.

GET California Overtime Calculator

How to use the California Overtime Calculator?

To access the California Overtime Calculator, click on the link you'll find right above the screenshot.

Once you click the Download link, a new tab will appear with a question: Would you like to make a copy of the XYZ document?

Afterward, simply click on the Make a copy button (you'll need to be logged into your Gmail account for this to work), and this will let you copy and edit the document. You'll then be able to use the calculator.

Immediately after downloading the calculator, you can start by entering your hours worked.

You’ll notice that there’s a separate cell for each day in a week — which can be a great asset in case you don't have a weekly timesheet totaling your work hours.

This calculator will take into account any time clocking over the expected 8 hours daily, and multiply it with the appropriate rates.

Get an accurate portrayal of your work and overtime hours with Clockify

An overtime calculator is a handy tool to help you better understand your work hours and overtime wages. It's also useful if you ever doubt you're being paid fairly or just want to know what kind of payout to expect after all the hours worked.

Still, a calculator might fall short in letting you obtain the most accurate numbers on your overtime pay — especially if you don’t have enough data to begin with, such as logged hours and reports.

However, when you use a work hours tracker such as Clockify, you can easily capture all the information needed to calculate overtime.

Clockify features include:

- Time tracking,

- Billing,

- Invoicing, and

- Reports.

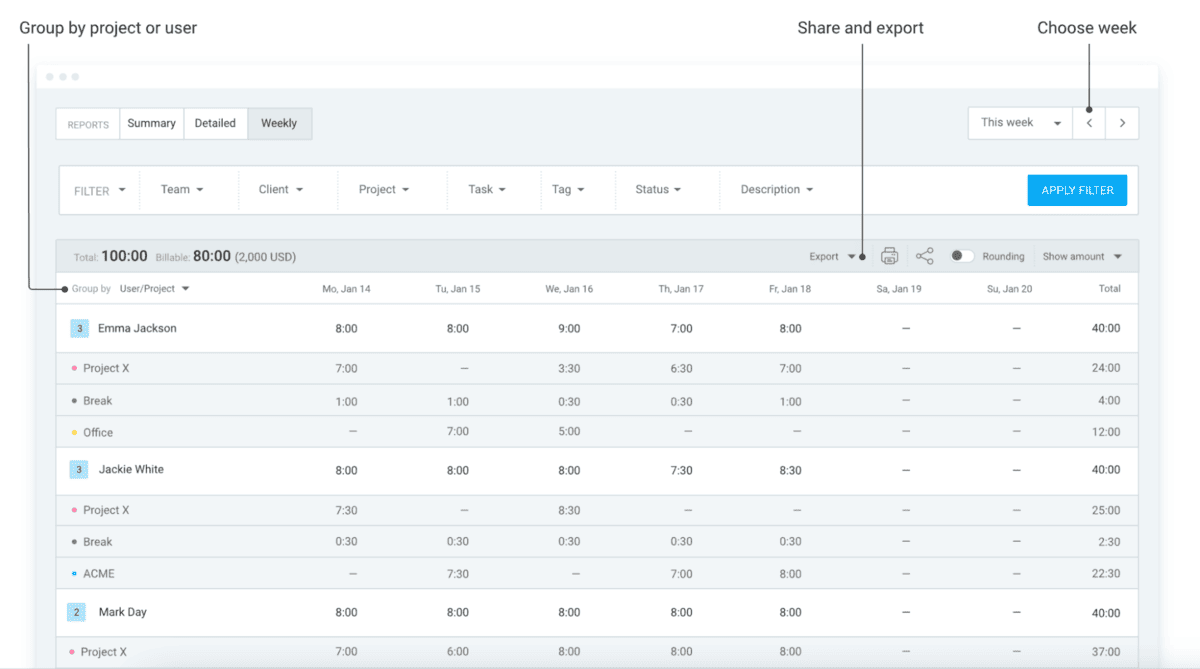

If you use Clockify to keep track of your work hours, you’ll quickly obtain a timesheet with all billable and non-billable hours logged, including a detailed report of all your time entries.

Weekly time reporting and overtime calculation

For example, the Weekly Report option gives you a glimpse of how users spend their time during the week. In fact, you can view their total work time and time spent on each project.

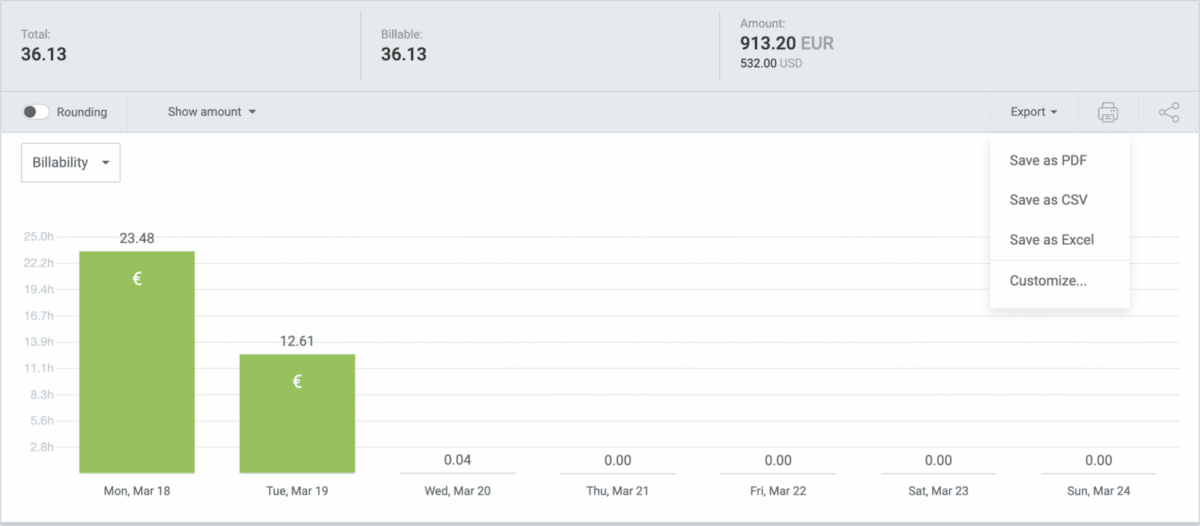

You can also export your data as PDF, CSV, or Excel files and easily import all the critical numbers to your preferred overtime calculator. Here’s how you can do that:

- Select the report you want to export (Summary, Detailed, or Weekly),

- Click on the Export button in the right part of the screen, and

- Select the format you want (PDF, CSV, or Excel).

Exporting in Clockify

Never get confused about payments for overtime work again. Calculate your earnings and plan ahead with Clockify.